Pakistan’s real estate sector has been one of the most attractive and lucrative investment options for many Pakistani investors, especially in the urban areas. According to a report by Graana.com, some of the top real estate investors in Pakistan have a net worth of billions of dollars and have made their fortunes by investing in land, housing, and commercial projects.

However, Pakistan’s garment industry, which is one of the largest and oldest industries in the country, has been struggling to grow and compete in the global market. According to the International Trade Center, Pakistan’s garment exports increased only from $2.3 billion to just $10.7 billion over the last 20 years, whereas Bangladesh’s garment exports increased from $5 billion to $55 billion in the same period.

What are the reasons for this huge gap in performance? What are the challenges that Pakistan’s garment industry faces today? And most importantly, how can the Pakistani government encourage Pakistani investors to invest in building garment factories instead of investing in real estate?

Why do Pakistani investors prefer real estate over garment industry?

- Higher returns: Real estate investment offers higher returns than garment industry investment, especially in the short term. The real estate investment can yield up to 30% annual returns, whereas garment industry investment can yield only up to 10% annual returns

- Lower risks: Real estate investment involves lower risks than garment industry investment, especially in the long term. Real estate investment is less affected by market fluctuations, political instability, and global competition, whereas garment industry investment is more vulnerable to these factors.

- Easier access: Real estate investment is easier to access than garment industry investment, especially for small and medium investors. Real estate investment does not require much technical knowledge, expertise, or infrastructure, whereas garment industry investment requires all of these.

- Greater prestige: Real estate investment is more prestigious than garment industry investment, especially for social and cultural reasons. Real estate investment is seen as a symbol of wealth, status, and power, whereas garment industry investment is seen as a low-value and low-skill activity.

How can the Pakistani government encourage Pakistani investors to invest in garment factories?

Based on the analysis of the reasons why Pakistani investors prefer real estate over garment industry, we can suggest some strategies that can help the Pakistani government encourage Pakistani investors to invest in building garment factories instead of investing in real estate. These strategies are:

- Increase incentives: The Pakistani government should increase incentives for garment industry investment, such as tax exemptions, duty drawbacks, cash subsidies, bonded warehouse facilities, and export processing zones. These incentives can reduce the costs and increase the profits of garment industry investment.

- Reduce barriers: The Pakistani government should reduce barriers for garment industry investment, such as bureaucratic hurdles, regulatory constraints, access to finance, infrastructure gaps, and skills shortages. These barriers can increase the risks and difficulties of garment industry investment.

- Raise awareness: The Pakistani government should raise awareness about the benefits and opportunities of garment industry investment, such as market potential, value addition, innovation, and social impact. These benefits and opportunities can increase the attractiveness and prestige of garment industry investment.

- Create partnerships: The Pakistani government should create partnerships with local and foreign stakeholders, such as industry associations, chambers of commerce, development agencies, and global brands and retailers. These partnerships can facilitate access to information, resources, networks, and markets for garment industry investment.

Real Estate vs Garment Industry: A Comparative Analysis of Economic Impacts

Real estate and garment industry are two of the major sectors of the economy that attract a lot of investment from domestic and foreign sources. Both sectors have their own advantages and disadvantages in terms of economic impacts, such as national wealth creation, employment generation, environmental sustainability, and social responsibility.

National wealth creation

One of the main economic impacts of investing in any sector is its contribution to the national wealth creation, which can be measured by indicators such as gross domestic product (GDP), gross value added (GVA), and net exports. Both sectors have a significant impact on the national wealth creation, but the garment industry has an edge over the real estate sector in terms of net exports.

Employment generation

Another important economic impact of investing in any sector is its contribution to the employment generation, which can be measured by indicators such as employment rate, labor productivity, and wages. Both sectors have a significant impact on the employment generation, but the garment industry has an edge over the real estate sector in terms of employment rate and wages.

Environmental sustainability

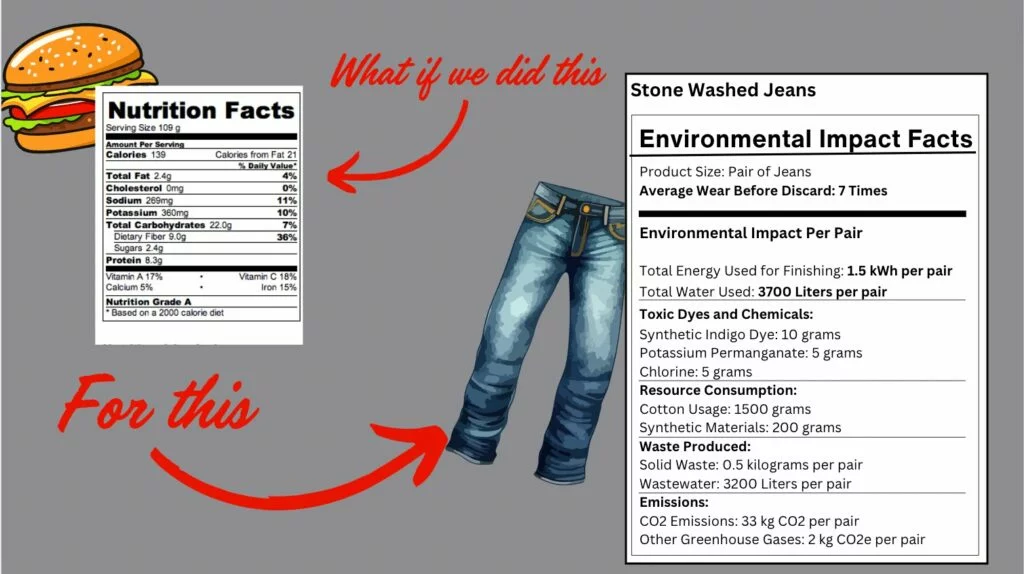

A third economic impact of investing in any sector is its contribution to the environmental sustainability, which can be measured by indicators such as greenhouse gas emissions, water consumption, and waste generation. Both sectors have a significant impact on the environmental sustainability, but the garment industry has an edge over the real estate sector in terms of greenhouse gas emissions and water consumption.

Social responsibility

A fourth economic impact of investing in any sector is its contribution to the social responsibility, which can be measured by indicators such as labor rights, health and safety, and community development.

- Real estate: According to a report by Human Rights Watch, the real estate sector has been involved in several cases of land grabbing, forced evictions, and displacement of local communities in Pakistan, violating their human rights and dignity. The sector also faces issues of corruption, tax evasion, and money laundering, undermining the rule of law and accountability. Moreover, the sector has a low level of health and safety standards for its workers and customers, exposing them to risks of accidents, injuries, and diseases.

- Garment industry: According to a report by Human Rights Watch, the garment industry has been involved in a fewer cases of labor rights violations in Pakistan, such as low wages, long hours, child labor, forced labor, and harassment as compared to real estate sector. However, the sector has a high level of community development initiatives for its workers and customers, providing them with education, health care, and empowerment opportunities.

Based on these indicators, we can conclude that both sectors have a significant impact on the social responsibility, but the garment industry has an edge over the real estate sector in terms of community development.

Conclusion

Real estate and garment industry are two of the major sectors of the economy that have different economic pros and cons in terms of national wealth creation, employment generation, environmental sustainability, and social responsibility. Based on our comparative analysis, we can say that the garment industry has more advantages than disadvantages compared to the real estate sector. Therefore, we recommend that investors should consider investing more in building garment factories instead of investing in real estate. Pakistan’s garment industry has a huge potential to increase its exports and compete in the global market. However, it needs more investment from local investors to build more garment factories and create more jobs and value. The Government must take necessary measures to incentivize investment in the garment sector, which is highly labor-intensive and has huge potential for employment generation for a country which has become the 5th most populous in the world.