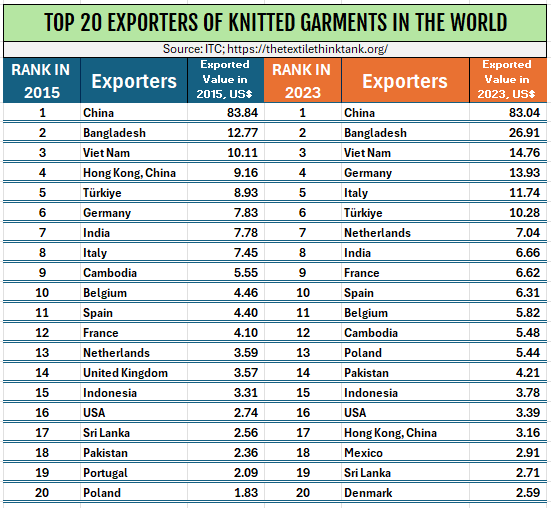

The global textile industry is undergoing significant shifts, as evidenced by the latest rankings of the Top 20 Exporters of Knitted Garments. Comparing 2015 to 2023, we see emerging players, shifting market dynamics, and new strategic opportunities for manufacturers, policymakers, and investors. Let’s dive into the latest trends in knitted garment exports.

Key Takeaways from the Data

1. China Retains Leadership, But Its Dominance is Shrinking

China remains the world’s top exporter of knitted garments, with an export value of $83.04 billion in 2023—almost identical to 2015’s $83.84 billion. While its absolute numbers remain high, its share of global exports has declined due to rising production costs, trade tensions, and supply chain diversification.

🔹 Actionable Insight:

- For Industry Leaders: Brands sourcing from China should diversify supply chains to reduce dependency and mitigate risks from geopolitical uncertainties.

- For Policymakers: China must focus on high-value, technology-driven production to maintain its competitive edge.

2. Bangladesh’s Rapid Growth & Market Expansion

Bangladesh has nearly doubled its export value, from $12.77 billion in 2015 to $26.91 billion in 2023. Its stronghold in cost-effective production, along with sustainability initiatives, has strengthened its position as the second-largest global exporter.

🔹 Actionable Insight:

- For Industry Leaders: Investing in Bangladesh’s eco-friendly factories and skilled workforce could yield long-term benefits.

- For Policymakers: Continued improvements in infrastructure and labor rights can further boost Bangladesh’s growth.

3. Vietnam’s Steady Climb in Global Rankings

Vietnam has jumped from $10.11 billion in 2015 to $14.76 billion in 2023, maintaining its position as the third-largest exporter. The country’s strong trade agreements and stable manufacturing environment make it an attractive alternative to China.

🔹 Actionable Insight:

- For Industry Leaders: Consider Vietnam for diversified production with strong trade benefits (e.g., CPTPP, EVFTA).

- For Policymakers: Strengthening logistics and local raw material production will make Vietnam even more competitive.

4. Europe’s Growing Role in High-Value Exports

Germany and Italy have climbed the rankings, reflecting Europe’s emphasis on premium, sustainable, and technologically advanced textiles. Germany’s exports surged to $13.93 billion, overtaking Hong Kong and closing in on Vietnam.

🔹 Actionable Insight:

- For Industry Leaders: European brands should leverage their expertise in high-quality, sustainable textiles.

- For Policymakers: Supporting innovation and sustainability initiatives will drive further growth.

5. Hong Kong’s Decline & The Rise of New Players

Hong Kong has slipped from 4th place (2015) to 17th place (2023) due to shifting production to mainland China and Southeast Asia. Meanwhile, Pakistan has also improved its ranking.

🔹 Actionable Insight:

- For Industry Leaders: Explore emerging manufacturing hubs like Pakistan and Mexico for cost-effective alternatives.

- For Policymakers: Countries aiming to become textile hubs must focus on trade agreements, labor skills, and infrastructure.

Conclusion: Navigating the Future of Knitted Garment Exports

The global textile industry is evolving, driven by cost efficiency, sustainability, and trade policies. While China remains dominant, Bangladesh, Vietnam, and European markets are growing rapidly, and new players are emerging.

📌 Key Strategies Moving Forward:

✅ Brands should diversify sourcing to mitigate risks.

✅ Governments must invest in sustainability and workforce development.

✅ Technology & automation will be key for future competitiveness.